Now Reading: Gold Prices Surge in Global and Local Markets – Key Updates on Bullion Trends

-

01

Gold Prices Surge in Global and Local Markets – Key Updates on Bullion Trends

Gold Prices Surge in Global and Local Markets – Key Updates on Bullion Trends

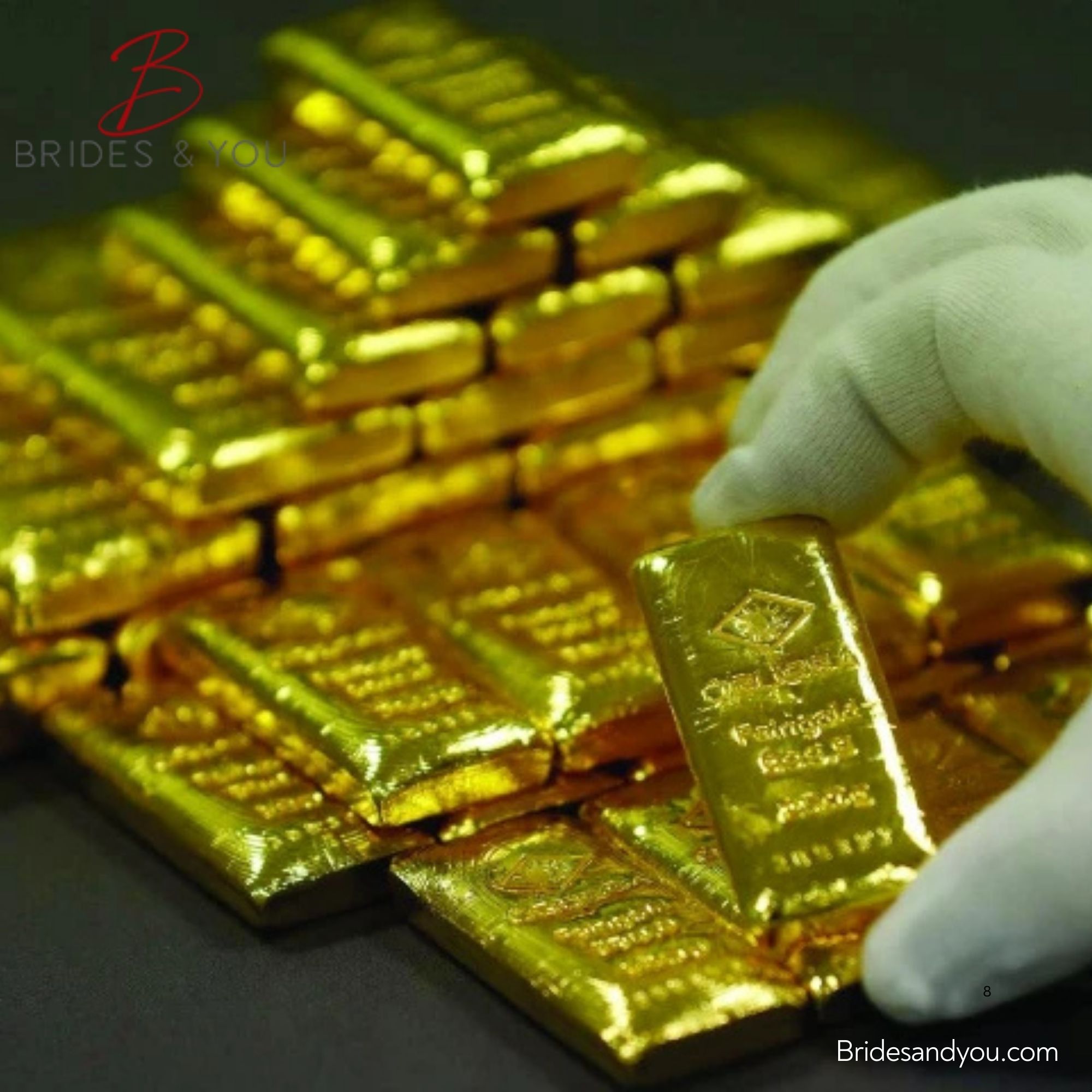

The gold market continues to see a significant upturn as prices climb both internationally and domestically. Investors and consumers alike are closely watching the latest movements in the bullion market as the value of gold continues to rise.

Global Gold Prices Hit New Highs

In the international bullion market, the price of gold jumped by $11 per ounce, reaching $3,356. This marks a strong continuation of the bullish trend observed in recent weeks. A combination of geopolitical uncertainty, inflation concerns, and a weakening dollar is driving investors to seek the security of precious metals like gold.

This steady climb in global prices is a reflection of market sentiment that sees gold as a reliable hedge in times of economic volatility.

Local Gold Prices in Pakistan Reflect Global Trends

The rising global prices are directly impacting local markets in Pakistan. According to the latest updates, the price of 24-karat gold per tola has increased by Rs1,100, now standing at Rs358,100. Similarly, the price of 10 grams of gold has seen a rise of Rs944, bringing it up to Rs307,013.

This surge is particularly relevant for traders, jewelers, and even individuals looking to invest in gold for savings or as a hedge against inflation.

Silver Prices Also Witness a Sharp Rise

While gold remains the center of attention, silver is not far behind. In the local market, silver per tola rose by Rs85, now priced at Rs4,022, and 10 grams of silver went up by Rs73, totaling Rs3,448.

Internationally, spot silver surged by 3.9%, reaching $38.46 per ounce, its highest level since September 2011. This dramatic increase signals renewed interest in silver as both an industrial metal and an investment asset.

What This Means for Investors and Buyers

The sharp increase in gold and silver prices is a signal to both new and seasoned investors. If you’ve been considering buying gold, now is the time to stay updated and make informed decisions. Precious metals continue to prove their importance as a financial safe haven, particularly during uncertain economic times.

Whether you’re looking to invest or are part of the bridal or jewelry industry, these price shifts are worth noting for future planning and purchasing.