Now Reading: Mobile Wallets Biometric Verification Becomes Mandatory from October 25, 2025

-

01

Mobile Wallets Biometric Verification Becomes Mandatory from October 25, 2025

Mobile Wallets Biometric Verification Becomes Mandatory from October 25, 2025

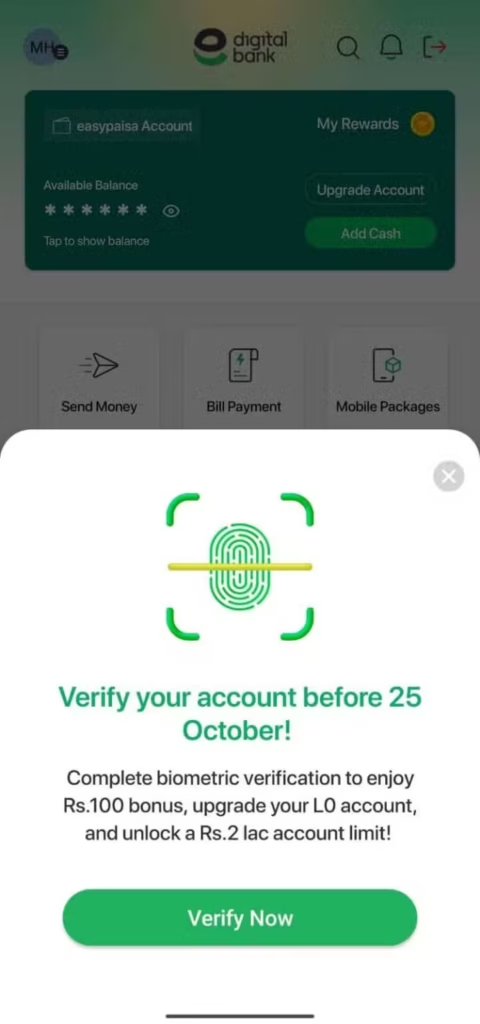

A major change is coming to Pakistan’s financial system. Starting October 25, 2025, millions of Pakistanis could lose access to their mobile wallets and digital bank accounts if they have not completed biometric verification. The State Bank of Pakistan (SBP) has made biometric verification a mandatory requirement under its updated Customer Onboarding Framework.

This move affects nearly all users of digital banking services, including those with microfinance banks, digital banks, and electronic money institutions. The policy aims to make Pakistan’s financial ecosystem more transparent and secure while also preventing money laundering and terror financing.

Why the SBP Introduced the New Biometric Rules

The SBP issued its new regulations in July 2025 through BPRD Circular No.1 of 2025. These rules make biometric verification the primary identification method for both new and existing customers.

According to the SBP, this step will:

- Improve customer security and prevent identity fraud.

- Strengthen anti-money laundering (AML) and counter-terrorism financing (CTF) controls.

- Simplify account opening and onboarding for individuals and businesses.

By enforcing biometric verification, the SBP aims to bring all financial institutions under a single verification standard, ensuring that both local and foreign currency accounts are properly authenticated.

Accounts That Will Be Affected by the New Policy

The new rules will apply to all SBP-regulated entities, including:

- Commercial Banks

- Digital Banks

- Microfinance Banks (MFBs)

- Development Finance Institutions (DFIs)

- Electronic Money Institutions (EMIs)

Customers who fail to verify their biometrics before October 25, 2025, risk having their accounts blocked or restricted. This means they will not be able to send or receive money, withdraw cash, or perform online transactions.

Experts estimate that tens of millions of users could be impacted if they miss the deadline, including those holding foreign currency and Roshan Digital Accounts.

Biometric Verification: What You Need to Do

If you haven’t yet completed your biometric verification, it’s important to act immediately. Here’s how you can do it:

- Visit your bank branch or authorized biometric verification center.

- Bring your CNIC (Computerized National Identity Card) for verification.

- Provide fingerprints through the biometric device.

- Wait for confirmation via SMS or email from your bank once the process is complete.

For digital-only banks or mobile wallet apps, the process may vary slightly, but most will guide users through the verification steps within the app or through a partner network of verification agents.

Why This Change Matters for Pakistan’s Financial Future

This new regulation is part of Pakistan’s broader strategy to strengthen the digital economy and make financial transactions more secure. Over the past few years, Pakistan has witnessed rapid growth in mobile banking and fintech adoption, with millions of people relying on JazzCash, Easypaisa, and NayaPay for daily transactions.

However, with growth comes risk. Fraud, identity theft, and unverified account usage have raised concerns for both customers and financial regulators. The biometric verification mandate ensures that every digital transaction can be traced to a verified user, enhancing trust and accountability in the financial system.

Deadline and Possible Consequences for Non-Compliance

Financial institutions were given a three-month window to ensure full compliance with the new requirements. The State Bank of Pakistan has not announced any extension to the deadline, making October 25, 2025, the final cutoff date.

After the deadline:

- Unverified accounts will face immediate debit restrictions.

- Users may lose access to send or receive money.

- Account restoration may require visiting the bank in person and completing the biometric process.

This policy is expected to affect millions of accounts across the country, particularly those belonging to expatriates, students, and freelancers who rely on digital wallets for remittances and online income.

How Banks Are Preparing for the Transition

Most banks and financial institutions have already started notifying their customers through SMS alerts, emails, and app notifications. Some banks are also offering extended working hours and special verification counters to help users complete the process smoothly.

Digital banks like Sadapay, NayaPay, and Raqami have rolled out in-app biometric verification features, making it easier for customers to comply without visiting physical branches.

The Bottom Line

The Mobile Wallets Biometric Verification rule marks a significant step in Pakistan’s journey toward a secure and transparent digital banking ecosystem. While the transition may cause short-term inconvenience, it will ultimately protect users from fraud and unauthorized access.

If you haven’t verified your account yet, now is the time to act. Visit your bank or digital wallet provider before October 25, 2025, to ensure uninterrupted access to your funds.