Now Reading: NEW INCENTIVES UNVEILED TO BOOST GLOBAL REMITTANCES

-

01

NEW INCENTIVES UNVEILED TO BOOST GLOBAL REMITTANCES

NEW INCENTIVES UNVEILED TO BOOST GLOBAL REMITTANCES

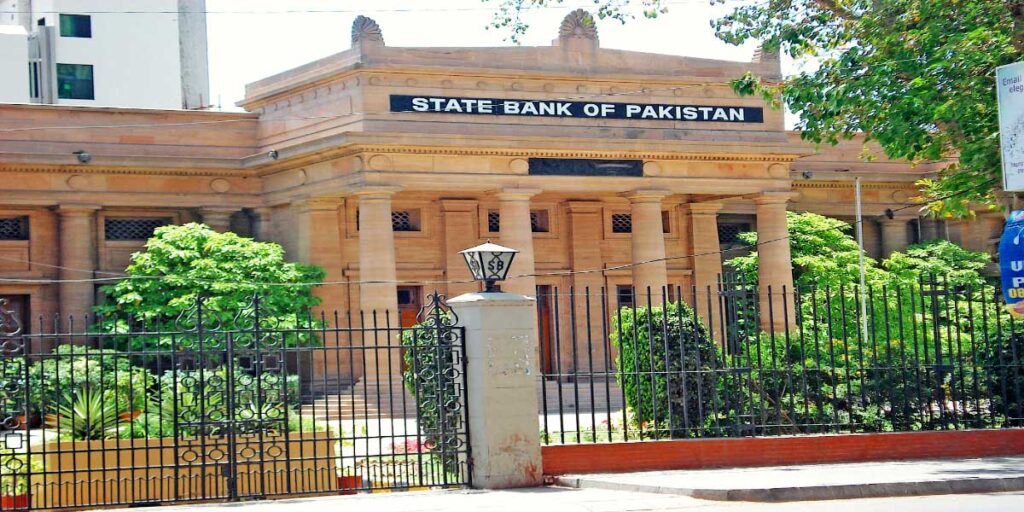

ISLAMABAD: To promote increased remittance inflows through official banking channels, the State Bank of Pakistan (SBP) has suggested performance-based incentives for banks and exchange companies.

The deputy governor of SBP stated that the existing incentives, which are transaction-based, need to be changed to place a greater emphasis on performance during a recent meeting of the Economic Coordination Committee (ECC), according to sources who spoke with The Express Tribune.

The incentive base rate used to be 30 Saudi Riyals (SAR) for every $100 transaction. This base incentive has now been suggested by the SBP to be reduced to 20 SAR for every $100 transaction.

For growth up to 10% or $100 million over the prior year, whichever is lesser, an additional reimbursement of 8 SAR would be given for each new qualified transaction.

If growth exceeded 10% or $100 million, an additional refund of 7 SAR would be given.

During the conference, questions were raised regarding the existence of a cost-benefit study, given the potential financial repercussions of the scheme for the national exchequer.

The central bank responded by stating that this program had been in place for years and had shown to be successful in boosting remittances, generating close to $30 billion yearly. Lowering the base rate from 30 SAR to 20 SAR would also assist in bringing down the total amount that the government charges for Telegraphic Transfers (TT).

Other recommended adjustments regarding exchange businesses were also outlined by the SBP official. The committee was informed by the Finance Division that the government has put in place a number of programs to promote remittances through official channels, including the Pakistan Remittance Initiative (PRI) and SBP.

Remittance inflows have steadily increased since these plans were updated in 2023. Remittances had a favourable cumulative gain of 10.7% year over year for FY 2024, coming in at $30.3 billion as opposed to $27.3 billion for FY 2023.

SBP has suggested more changes to two Home Remittance Incentive Schemes that the ECC/Cabinet first accepted and that now need ECC approval. Payment of the TT fees

This program, which was introduced in 1985, attempts to offer senders and recipients in Pakistan free remittance transfers for amounts above $100.

A consistent incentive is given to participating banks and financial institutions for qualified transactions. Last year, the incentive rate was increased to 30 SAR, which had a favourable effect on remittance inflows. Currently, SBP suggests breaking up the flat 30 SAR reimbursement into components that are fixed and variables.

With the fixed component, all qualified transactions above $100 would receive 20 SAR.

In order to support growth up to 10% or $100 million, whichever is smaller, the variable component would offer an extra 8 SAR for each additional qualified transaction.

An extra 7 SAR would be given for each additional transaction in the event that growth surpassed 10% or $100 million. Under this arrangement, banks that meet greater remittance inflow targets can get up to 35 SAR for each qualified transaction. Performance is assessed on a monthly basis, and adjustments are made during the last quarter of the fiscal year.

SBP thinks that these changes will encourage banks to send more money home while also possibly lowering the total amount of money the government spends on TT charges.

Program of incentives for EC.

This program, which goes into effect in 2022, promotes exchange firms (EC) to give up all of their foreign exchange holdings in the interbank market. Currently, one rupee is mobilised for every USD. The SBP suggests giving SBP-designated banks the set base rate for USD relinquished in the interbank market an increase from Rs1 to Rs2.

A variable component would also provide an additional Rs3 per USD for additional remittances up to 5% or $25 million, whichever is less, and Rs4 per USD for growth above 5% or $25 million.

Payments would be made in accordance with SBP-specified percentages for the surrender of foreign exchange, with performance being assessed on a monthly basis and modifications being made in the last quarter of the fiscal year.

According to SBP, these changes will incentivise exchange operators to facilitate more remittance transfers, hence mitigating their augmented operational expenses.

ECC consent

Accepting SBP’s proposed modifications to the TT Charges Scheme and the Incentive Scheme for Exchange Companies, the ECC of the Cabinet took a look at the Finance Division’s summary of the “Proposal for Revision in Home Remittances Incentive Schemes”.