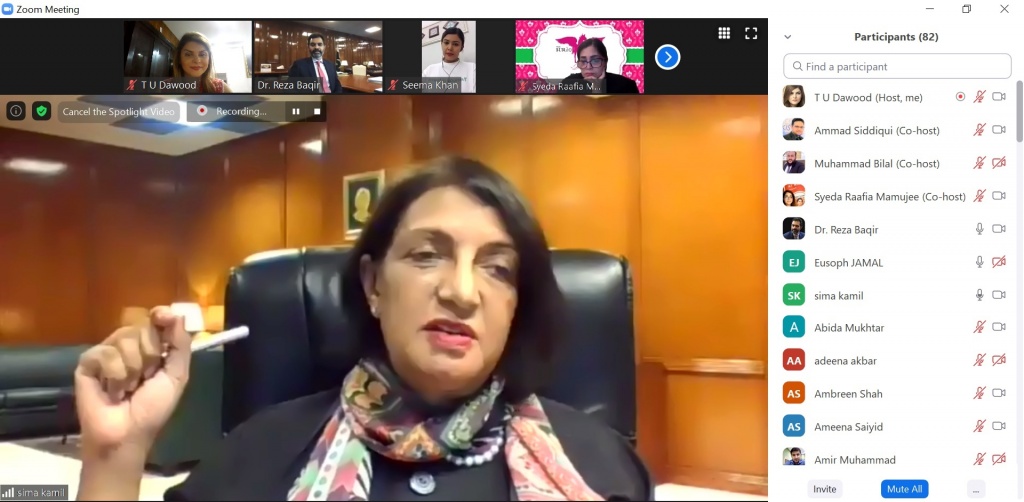

LADIESFUND, a women empowerment project of the tax-exempt charitable foundation Dawood Global Foundation, held a dynamic interactive and information session with the State Bank regarding their special loan scheme for women SMEs. More than 300 women registered for this seminar which was titled “LADIESFUND State Bank: Funding Buraqs,” in reflection of The Buraq Center by LADIESFUND – Pakistan’s first all-female incubation center. The webinar was done with the partnership of the Federation of Pakistan Chambers of Commerce & Industry, Canada Pakistan Business Council, Lean in Pakistan, Educate a Girl, Indus University, Indus Valley School of Art & Architecture, and Scentsation – is part of The Buraq Center virtual online series of trainings and facilitations.

Dr. Reza Baqir, Honourable Governor of the State Bank of Pakistan, whose background includes eighteen years of experience with the IMF including overseeing IMF’s loans and policies in emerging markets, spoke from his heart on the importance of financial inclusion and how available he and his colleagues were to facilitate loan applications. He stated, “I am delighted to be speaking at a webinar organized by The LADIESFUND. Financial inclusion and the importance of women in Pakistan’s economy are topics that are very close to my heart and topics that are very important for the State Bank of Pakistan.”

Women entrepreneurs were primarily from urban centers of Karachi, Lahore and Islamabad, but several women and young girls from Balochistan, Quetta, Lyari, Swat and across Pakistan also participated, eagerly wanting funding.

Ms. Sima Kamil, Deputy Governor of the State Bank of Pakistan, whose background includes being Pakistan’s first-ever woman appointed President of a private sector commercial bank – United Bank Limited – was a true inspiration for all attending. . She sincerely encouraged the attendees to apply for loans as well as to spread the word.

Syed Samar Hasnain, Executive Director SBP, also joined in the call, and answered technical questions as well as represented the history and legacy of the State Bank of Pakistan’s commitment to financial inclusion.

Interesting questions came up during the webinar which featured both speeches and Q&A. Atiqa Odho asked about hand-holding resources for women to cover the A to Z of creation of a start-up (not at this stage), Ameena Saiyid asked how long from application to disbursement (banks should decide if loan approved within 15 days of receiving completed application and then immediately disburse pending legal formalities) Rukhsana Sheikh asked about how Baloch women can qualify (they are encouraged to apply and would be welcome), and Uzma Khan, CEO of Sana Safinaz, asked if a point system could be used for companies with a solid track record of repayment (banks do already use a point system so it would likely be applied here), Nazli Abid asked how to get larger loans than this PKR 5 m State Bank scheme (apply under a regular gender-neutral scheme). Hafsa Zaki asked about virtual currencies (not allowed as too unsafe), and Mahbina Waheed asked why doesn’t State Bank not directly give loans (they are not allowed, SBP gives money to banks and banks give money to people).

In addition to the women who joined the call, there were several male dignities including Governor Kemal Afzar, Governor Yaseen Anwar, Canada Pakistan Business Council President Samir Dossal and First Dawood Group Chairman Rafique Dawood.

To view LADIESFUND’s social media accounts, visit:

Facebook: https://www.facebook.com/ladiesfund/

Instagram: https://www.instagram.com/ladiesfundofficial

Twitter: https://twitter.com/ladiesfund?lang=en

Website: http://www.ladiesfund.com/